The crucial role of CX in the UK’s fibre broadband gold rush

The fight for fibre broadband supremacy is on, and an army of alternative networks (‘alt-nets’) is joining the arms race.

Nearly 25% of known operators building fibre-to-the-premises in the UK were established in 2021 and 104 of them are now active. Some projects, like the £1bn deal between Transport for London (TfL) and BAI Communications, come with promises to boost major city infrastructure. Others, like The Common Wholesale Platform (CHP), look to open up new alt-net internet services providers (ISPs) to the general public with a stated aim to challenge Openreach’s dominance.

Largely, these upstarts are private equity-backed with ambitious growth plans: £8bn worth of investment and counting according to FT calculations. However, there’s good reason why the incumbents dominate, and displacing them will be beyond a mammoth task.

Whether it’s a race against each other or a challenge to major player supremacy, how can these challenger brands gain ground in the battle for fibre broadband?

Prioritise the customer experience

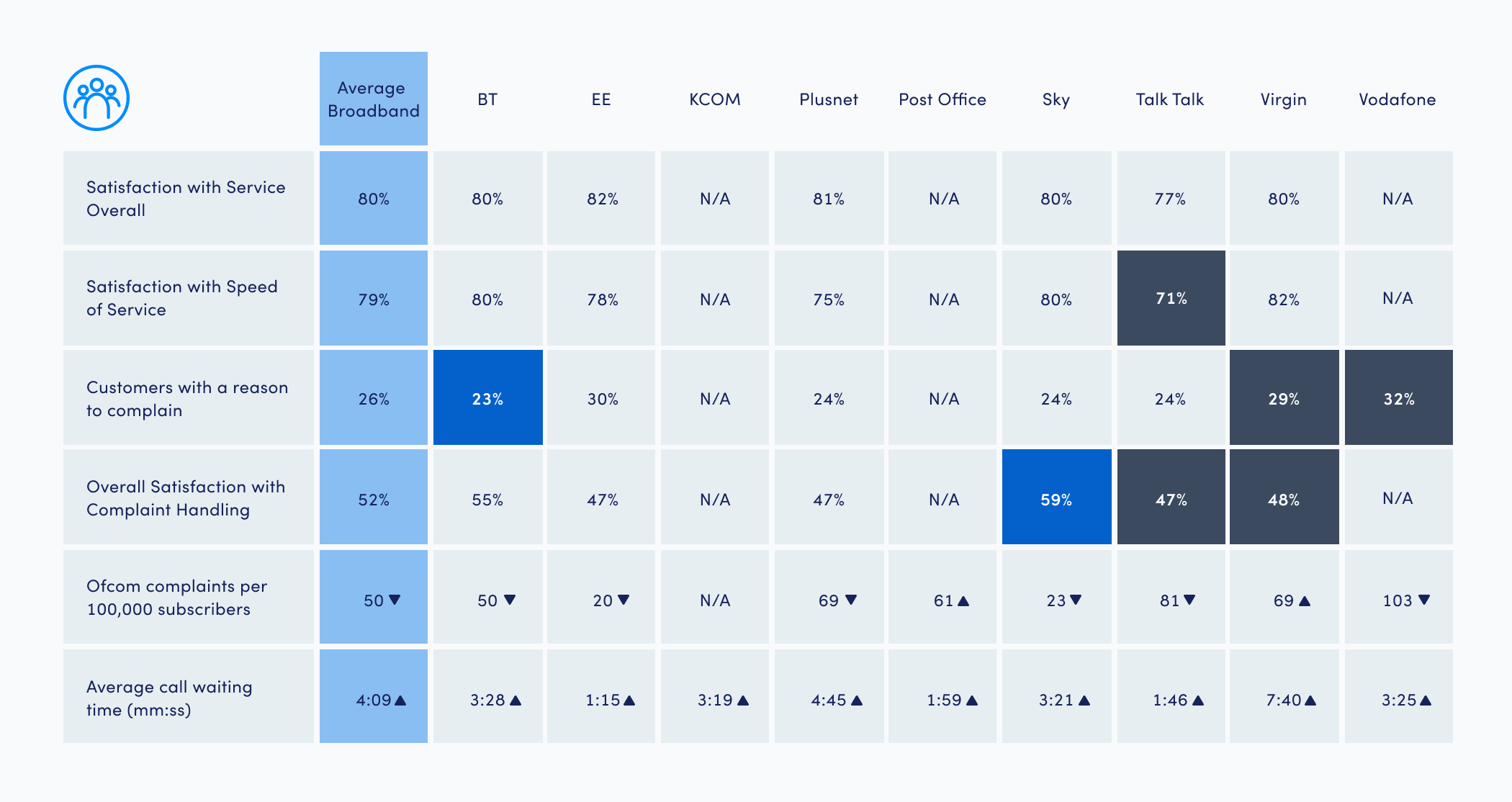

The first place to start is customer experience. A glance at Ofcom’s Annual Customer Service Report 2021 shows that established networks have a customer service problem. The issues are in two key areas – customer complaints and field service performance.

Source: https://www.ofcom.org.uk/__data/assets/pdf_file/0027/218655/comparing-service-quality-2020.pdf

Ofcom’s data shows that 26% of customers have reason to complain, and only 52% are satisfied with how that complaint is handled. A quarter of dissatisfied customers is a bad place to start. Their Trustpilot reviews (1.6/5 for BT and 1.5/5 for Plusnet, for example) also paint a picture of the problem. But why are they angry?

Fielding complaints

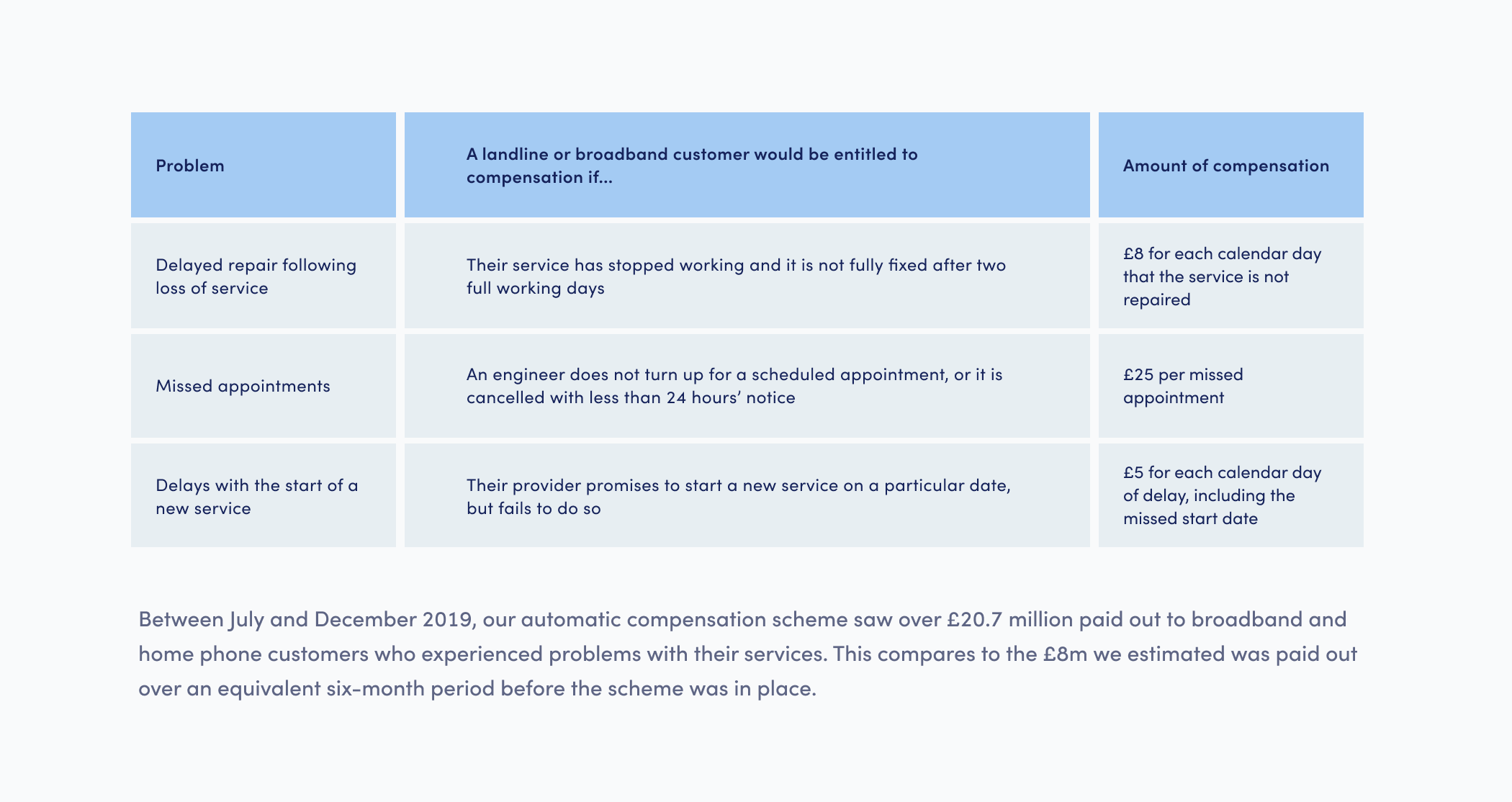

Well, when you look at the regulatory body’s Automatic Compensation Scheme, the data gets even more interesting. Partners in the scheme include BT, Sky, TalkTalk and Virgin Media and its role is to automatically compensate landline and broadband customers for the following field service problems:

- Delayed repair following loss of service – £8.06 per appointment*

- Missed appointments – £25.18 per appointment*

- Delays with the start of a new service – £5.04 per day*

*figures correct as per 2021

According to 2019 data – the most up-to-date figures available – Ofcom paid out £20.7 million between July and December 2019. To put this into context, if these pay-outs were all missed appointments at £25 each, that’s 828,000 missed appointments in six months between the seven participating companies, or 118,000 each.

It’s not a great leap to think that many of the complaints ISPs receive are down to poor field service performance. If someone doesn’t turn up to an appointment or your repair work is delayed, you will call to find out what’s happening. The opportunity for alt-nets to differentiate is clear.

Top of the list should be cutting down on service issues in the field. Ensuring that appointments are met, repairs on time and the service starts when it’s meant to will set them apart from incumbents. They can go further, ensuring engineers are well prepared with full customer and job details, and clear lines of communication with the customer in case of any issues.

This requires an investment in the way deskless workers operate, making scheduling software integral to the process and giving more autonomy to the people on the front line. Engineers are customer-facing, so are vital customer service agents, but today, they’re also expected to do more through cross-and-up selling on the job.

That means alt-nets must give them the tech they need to provide great service, with the power to go beyond standard procedure and book more appointments, to the people that matter most – customers.

Differentiation over saturation

The playbook for many alt-nets seems to be the same – invest heavily in infrastructure, the customers will come, then they can scale quickly. But Openreach and Virgin are investing too, and they have the resources to win this competition. Alt-nets can and should play a different game recognising that they have a huge last-mover advantage against incumbents – greater operational agility.

This opportunity becomes more vital when the battle for dominance has given rise to fears of over-saturation, with 75m lines set to be built according to the FT. The focus on product in this context will only get you so far. Pretty soon, alt-nets will have to prioritise customer service as their only differentiator – brand has already been done, and it’s practically impossible to differentiate on price as margins are so tight.

The opportunity to battle incumbents is there. But the real winners in the gold rush are the ones who can align their high-performance product with customer service excellence. Do that, and Openreach is not as out of reach as it seems.

Learn more about how powerful scheduling software can help get you closer to customers, or book a demo today.